EMPLOYER || CANDIDATE

EMPLOYER || CANDIDATE

Virtual Staff Benefits

Employer

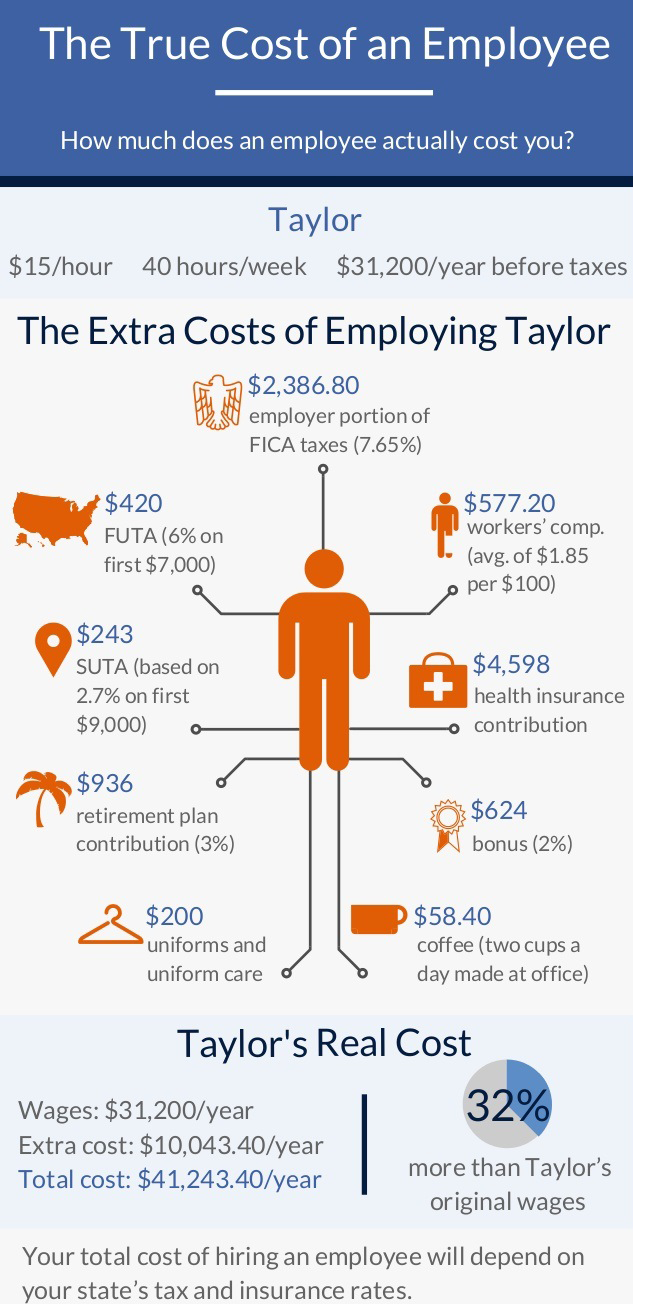

Real Cost of an Employee

Effective Solutions to lowering employee payroll and increasing company profits.

Hiring is always a difficult and important activity, especially in a rapid growth business. Delay in hiring and you will have trouble meeting your plan, hire too quickly and you may burn through cash before revenue catches up.

Our recommendation to clients starting out to expand into a virtual work force is to staff at 85% of forecasted needs and contract out the remaining 15%.

With better understanding of how to manage your virtual staff, you can quickly adapt and transition your current staff or hire new virtual employees.

The costs (basic salary, employment taxes and benefits) are typically in the 1.25 to 1.4 times base salary range.

For example; A $50,000 per year salaried employee on average will cost between $62,500 to $70,000.

Employment costs fall into several broad categories:

Recruiting Expenses.

Finding technically qualified people who can function effectively in a rapidly growing venture is not an easy task.

Basic Salary.

There is data that can help you calibrate an appropriate base salary to establish rational salary ranges given your growth plans.

This means that in most cases there should not be great salary differentials between early hires and later employees- any "risk component" of being an early hire should be made up in the equity compensation component.

Employment Taxes.

Preparing your payroll budget be sure to include allowances for Social Security and FICA (currently 6.2% on the first $90,000 of salary – www.ssa.gov), Unemployment and FUTA (6.2% on $7,000 of salary) and Medicare (1.45% with no salary cap – www.ssa.gov).

Workmen’s compensation premiums will depend on the category of your employee, with clerical at about 0.3% of salary and manufacturing at 7.5%.

Benefits.

In most cases you will need to provide some benefits. Typical benefits for a $50,000 salaried employee include life insurance ($150) and health coverage ($2,000-$3,000 for single persons; $6,000-$7,2000 for families - http://www.ahrq.gov).

Other benefits could include long-term disability insurance ($250), dental plans ($240-$650), dependent care assistance, tuition reimbursement, retirement plans etc.

These involve actual payment of benefits by the employer. There are also "self funded" plans where the employer contribution is the administrative costs- e.g. 401(k) savings plans where a portion of the employee’s salary is withheld. Vacation is another cost but is subsumed in the basic salary.

The costs to this point (basic salary, employment taxes and benefits) are typically in the 1.25 to 1.4 times base salary range- e.g. the cost range for a $50,000/year employee might $62,500 to $70,000.

Space.

Unless you are hiring traveling salespeople or you have a virtual staff, you need to provide some physical space to house the new employee. Obviously the rent per square foot varies depending on the fanciness and location of the facility, but how many square feet does an employee need?

This obviously varies but there are some guidelines. Work cubes are typically 8' x 8' in size and private offices range in size. In high tech figure on 225 to 250 square feet per employee when you add in common space. Furnishing the space, even with used work cubes will probably run $2,000 at a minimum.

Other Equipment.

The basics these days for high tech or office workers have to include a computer and telephone. Even with decreases in PC prices, figure on $500+ for a computer, $500 to several thousand for software and $250 to $300 on average per telephone and voicemail systems when you factor in service, equipment, and installation.

Don’t forget the periodic expensive upgrades, maintenance, house keeping, utilities, office supplies, security, are just a some of the additional business expenses.

Simple Rule of Thumb Metric.

Instead of figuring out each cost component separately you can develop some simple metrics.

An entrepreneur in the engineering services industry in which the clients are billed on projects on a time and materials basis created a simple metrics formula taking the employee’s base salary and multiplies it by 1.25 to cover employment taxes and benefits.

Multiply that number by 1.75 to cover rent, equipment etc. Because some in some case management staff is needed and some of the employee time is spent in non-billable ours, that number is multiplied by 1.25. Based on those calculations for the professional engineering consulting business, the fully functioning managed employee costs about 2.7 times the base salary.

A different metric for planning the manufacturing side of the business. In both cases even though the metrics are simple and easy to apply it has taken her some time to really understand the cost components of the business segments in order to develop the metric.

Although the "rule of thumb" is helpful in planning rapid growth, like any rule of thumb the underlying assumptions need to be recalibrated periodically.

Virtual Staff Efficiency Report

The Cost of Low Employee Engagement

$450-550 Billion

is the cost for the US Economy due to Disengaged Employees

6.19 Sick Days

Reported Number of Sick Days by Companies with Work Engagement Issues

A disengaged Employee Costs an Organization Approximately $3400 for every $10,000 in Annual Salary Earned.

$11 Billion

is Lost Annually due to employee Turnover

32.7%

Higher Opearting Income for Companies with Low Engagement

The Benefits of High Employee Engagement

38%

more likely to be productive than average employees

2.69 Sick Days

Reported Number of Sick Days by Companies with Engaged Works

202%

Companies with Engaged Employees outperform those without an engaged work force.

Organizations with highly engaged workers are safer. 48% less accidents, 41% less Quality Defect and 41% Lower Health Care Costs

89%

Less Likely that an employee leaves when the company has engaged its workforce.